Dec 2023 - Year-end review special edition

Some economic narration of the past 10 years. A theoretical portfolio on lessons of diversification & addressing the Big Elephant blindfolded.

First, the table that you are familiar; with 1 difference at the last column.

A continuation of Santa Rally from November, spurred by an anticipation of lower rates come 2024. This is evident from the positive performance on broad base bonds, especially the most sensitive longer tenured LT Gov Bond of 8.8% (Vanguard Long Term Treasury Mutual Fund - ticker: VUSTX). We’ll revisit this broad-based performance later.

There’s a special column for this month edition - 10-year annualised performance. This was included this month (only) as the 1-year performance is removed since it shares the same YTD performance column.

This is an important data point to assess the long-term resilience of asset classes (though only 10 years). It’s good exercise to assess once per year at least. Some highlights:

Tech/Nasdaq delivered an annualised 13.7% returns for past 10 years

Emerging Market, at 0.1%, what happened to middle-market income growth thesis?

All World (ex-US) at 1% p.a. versus US Total Market of 9.6%

Bonds or treasuries, a multi decade bull market due to low rates to ZIRP wiped out & decapitated in 2022 (excluding yield). Refer to chart below.

Commodities & oil in negative territory as explained later, this is expected with the positive progress of technology.

Bitcoin, the elephant in the room, at ~150% p.a. No other asset class comes to this kind of growth in history.

Note: as mentioned yield distribution is not included in this tracking, only price performance is track. Other than convenience in data capture, yield is hard to measure from compounding point of view as the dividend is not necessarily reinvested.

Historical economic lessons from the loser

Commodities (PIMCO Commodity Real Return Strategy Fund - ticker: PCRIX) & in particular US Oil Fund (ticker: USO) have the worst negative performance overall this year.

Additionally, Commodities in general has been on a long-term decline in these 10 years too. It’s a general knowledge that commodities (energy, metals, grains, etc) correlates positively with inflation. What can we interpret from here? No inflation? Or in fact no growth?

For transparency purpose, the PIMCO Commodities fund returned 3.7% annualised in both yield & price performance (i.e. Total Return) for the past 21 years since 2002.

The chart below tells a great economic history for the past 2 decades.

Pre-2004 to 2008 - this is the post WTO China boom, fuelled by the insatiable demand of iron ores (coal, copper, rare earths) & oil in general (crude & palm). At the same time, on the other side of the planet, a credit boom (due to declining borrowing rates) which promotes excessive consumption in discretionary items like properties, pushing price up from both supply (building materials) & FOMO demand. Whatever US wants, China can produce at scale cheaply.

GFC crash of 2008 - From tangible assets securitised into paper instruments with multiple tranches that we know as derivatives drove further into a vicious leverage loop that get pops. 1 house ownership is not enough, let’s do 10 for investment purpose. We all know how it ends where all asset classes correlate to 1. Let’s observe that we have not since reach the height of 2008 bull market in Commodities.

2010 - 2012 - This sharp spike, other than being a technical rebound, is caused by 2 main factors, that emerging markets like China still needs commodities for its growth & also the effect of never-before-seen ZIRP (Zero Interest Rate Policy as a remedy to GFC) took place. Naturally, with such first of its kind policy, we see USD declined in this period against emerging market currencies.

Side note: Airbnb was founded in 2008, WhatsApp & Uber in 2009, Instagram & Pinterest in 2010, Dollar Shaves Club & Chewy in 2011, Snowflake in 2012 & in the same year Facebook is listed & bought Instagram for $1b. Recessions didn’t create them, ZIRP did as the price of risk is distorted.

2012 ‘till now - Downward pressure from a perfect combination of increase supplies & declining demand for commodities. ZIRP, as bad of a policy it is, promoted heavy investments not only in Silicon Valley but also multiplied efficiencies of oil extraction by a few-fold through fracking. This caused the 2014 oil price crash as supply becomes abundant.

With slowdown of China (caused by a normalisation of debt-fuelled US consumerism earlier) and the intermittent COVID spike (from negative oil price) or geopolitical shock; commodities as a basket in general has not been stellar. Supply > Demand in 1 simple equation.

What’s even interesting is that this PIMCO Commodities fund actually strips away the effect of inflation in its strategy. If you re-read the chart & narrative above, it will make much more sense without the impact of inflation.

A negative annualised real return either shows that inflation is really high, or the actual return itself from the commodities is just negative (or very low).

Since we’re analysing commodities, this tells us vividly that overall growth in the (old) economy in general is either dismal or in decline. On the flip side, we can also argue that technology advancement (the new economy) has increased efficiencies & productivities, requiring lesser physical attribute of labour & land (that demands commodities).

What 1 hand gives, the other hand must take though, capital (as the 3rd pillar apart from land & labour on productivity) has increased significantly as we read further.

1 more apparent loser, VIX, the volatility index, is unusually suppressed. Any shock to the system will have violent reactions moving forward.

Capital as a form of scalable resource, unlike labour or land

Liquidity is what scalable capital is. To understand the impact of liquidity is key in reviewing what happened the past 12 months.

First in January 2023, there was a big bounce coming from a very bad 2022 year where US had the steepest & fastest rate hike in history; liquidity was sucked out from the market & into USD (in treasuries). More about this from the Dollar Milkshake Theory explainer video.

It was only a temporary relieve as fed rate continues to hike when the February’s FOMC decision was made. Hence, a drastic reversal in February’s performance.

March onwards is where rates hike decouples from asset prices due to a moral hazard (again) of the fed rescuing banks. I have written a LinkedIn post about how the fall of Silicon Valley Bank is inevitable.

To protect the financial system, US Fed created the Bank Term Funding Program, allowing banks to borrow from it to repay back depositors should there be a need. As of December 2023, $135 billion has been loan out. This shows how much banks don’t have in their reserves in satisfying depositors’ withdrawal!

Such artificial quantitative easing has pump liquidity into the market, regardless of if rate hike continues until July 2023 at 5.5%. Please note that this program will expires in March 2024 as stated in the FAQ.

Oil price rallied in July & August to touch a high of $97 in September. This explains the jittery in other asset classes in the same period as the fear or another rate hike is impeding in September since oil is highly correlated to inflation. Really?

Chartist believes that price actions can tell tomorrow news today. On Oct 7, a surprise missiles attack was launched on Israel from the Gaza strip. Oil price since then has only declined, after a geopolitical event occurring, rather than further increase as logic dictates. In fact, the increase was 2 months before. Buy the rumours (extremely inside militia intel), sell the news?

Note: To re-iterate the Cash asset class shows ~0% throughout but it actually pays a yield of equiv. to the risk-free rate, or the fed fund rate at that particular time frame. So, for e.g in Sep & Oct where things are red, Cash is giving ~0.9% of returns (~5.5%/12*2) for the 2 months.

The bottom part of the table shows a simulated portfolio assuming of equal weight in the 25 assets tracked. VIX is used as a volatility benchmark & not being used for portfolio analysis.

Capital attracts capital since it is highly fungible. It goes where it can give the highest form of returns with the lowest risk. Regulations is what restricts the flow. This is where all conspiracies come in. My notes below on Prof’s Damodaran class should further explain this:

Class 4 Valuation: Risk & Risk-free rates

Class opening test: You have a choice of valuing a Brazilian company, either in US$ or in R$. Risk-free rate, Rfr for US is 2.5% & Brazil is 7.5%. Which currency will give you a higher valuation? a) US$, because of lower Rfr which will give a lower discount rate

Diversification to protect extreme downside but the reward is in the risk (volatility)

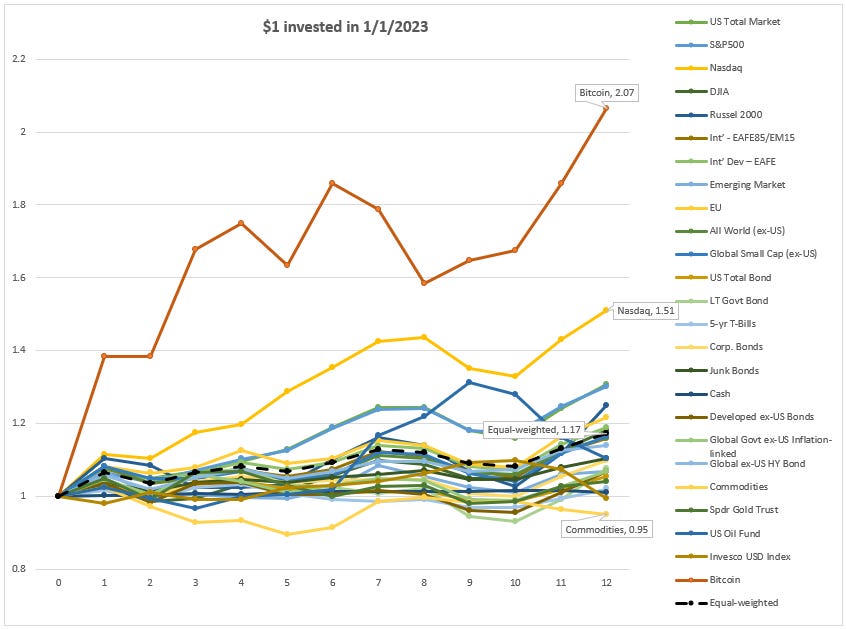

If we were to invest $1 in each of the 25 items in the table (except for VIX) on 1/1/2023, just by the 1st month alone we’re up 6.6% and ended the year with a 17.2% gain; as visualised in the chart below in the black dashed line.

The objective of diversification is more for downside protection. Imagine you’re a commodity or oil trader/investor, wouldn’t it make sense to hold some Bitcoin as a diversifier? Otherwise, you’re down 5% for the year, vs a 17% portfolio gain at least.

We also don’t want to eliminate volatility totally as it provides the upswing. This is the true benefit of having a portfolio.

Look at the bottom right green cell. This equally weighted, multi-asset global portfolio delivered a 9.9% of volatility while earning a 17.2% return.

Despite the large volatility swing in Bitcoin of 162%, or even the broader Russell 2000 of 76%. We can definitely sleep soundly at night with just 9.9% volatility. Diversification is indeed a free lunch.

The beauty of portfolio construction is the ability to optimise further for higher returns or lower volatility which we won’t cover here, but this is really the best kept secret.

Elephant in the room, with everyone blindfolded, what is it?

Scroll back to the 1st table above, Bitcoin compounds at 150% p.a. for the past 10 years; outperforming the Nasdaq by at least 10x. Objectively, we can’t ignore this performance even as it generates a lot of argument.

Some inference we can gather based on analysis so far on lessons learned above:

The real economy is not growing as it used to, but money supply has been high, even until today. All the money went where?

All of the liquidity is channelled not into local infrastructures (capital goods) but fungible ‘infrastructures’ like treasuries, bonds, VC, PE or even Crypto. The former enables economic multipliers, the latter allows a rug pull. We’re in all time high too in terms of stock market capitalisation vs GDP (don’t forget to click the map button for a global view).

Moral hazard of banks being too big to fail and is being bailed out, again & again. In March 2023 when the banking system shows some cracks, Bitcoin ended with 21.3% gain. When 1 bank is failing, the best the government can do is to force a marriage with another stronger bank like what the Swiss government did on UBS & Credit Suisse. Providing a back stop just to calm the financial system has been a bad precedent. Just like subsidies, it’s hard to weaned off.

Majority of the profits and surpluses are reflected in asset price rather than salaries (with the exception of tech sector). Remember, real economy isn’t growing much if it isn’t already declining. Hence, rich get richer, poor get poorer. Middle class? Get hit even harder.

Cash rich corporates buying over competitors, making themselves going from big to mega. The economic engine, many individual companies, literally shrinks through the decades. Peak of listed companies in US was in 1996. 2 years later the Asian Financial Crisis struck.

If we are to rewind further just post WWII, everyone can get rich & live comfortably in sync. All the boomers enjoyed the peace dividend. When they look next door, they see the same reflection of wealth. Today, wealth growth is out of sync and is amplified by social media. We’re no longer comparing next door neighbours, but with someone 10,000km away selected by the algorithm. This observation is inspired by Morgan Housel’s books.

Post GFC, as we know from above, startups are born. The distrust & dissents also gave birth to Bitcoin. A democratic digital instrument that everyone can have access to, with full faith & trust while most of the ‘wealth’ is still being guarded in the traditional basket of stocks & bonds.

The trust system was reset during the Bretton-Woods collapse. A new trust was born then with a system called fiat with the buy-in of G5 countries. So, why can’t this reset be happening as well? All we need is just buy-ins from a few countries. This is actually 1 scenario from the Milkshake Theory.

To the masses, Bitcoin is perhaps the last hope of wealth accumulation.

Bitcoin today divides people very much like politics & religion. Such division normally presents profit opportunities, this is why politicians play this game of divide & conquer. If we can’t agree it as a cash-flow generating asset, or a stable frictionless currency, while some regulation still debating if is a security, then can we view it as an art? Art or wine do have a price & it appreciates when is scarce right?

If there’s a price, there’s a market.

Without going to sound too hyperbolic or conspiring, we can try the behavioural route. Due to the 2022 crash of tech & crypto, a lot of punters got burned, losing close to 80% if they bought at peak. If you ask them today or maybe even 6 months back what’s their view of crypto. The normal response is “ugh”, I wouldn’t touch it. This & with the diaspora, to me, is a buy signal. Litmus test is in these 2 weeks, right?

Lastly, because this asset class is still nascent, volatility & big swings are expected. The institutions are slowly allocating in this space. While Blackrock’s Bitcoin ETF is still up in the air as of current date of publishing. Blockchain technology is already being use in institutional fund management via Polygon.

Imagine pension fund starting with only 1% & slowly moving to 5% of the entire strategic asset allocation model while at the same time supplies shrinks by design. How to accumulate at lowest cost? Crashes are bound to happen, a lot more. Want to sleep soundly? You know what to do.

Epilogue: The Yale Model

Asset allocation is the 1st step to investment decision making. Not stock picking, or whether leverage should be use on Crypto. David Swensen pioneered the Yale Endowment Fund model, where he focused heavily on equity & alternative investments (VC, PE, Hedge Funds & even forests).

The fund returned ~11% p.a. over 20 years until 2021 where similar other endowments earned only ~7%. In 2021 alone, it earned 40%!

This outlier model differs vastly from the traditional 60% fixed income & 40% equity model of most institutions. 1 clear distinction is to give up liquidity for that additional premium. Unlike pension funds with a pension liability, endowment only needs to make enough to pay for the university’s opex. Hence, they can afford to forgo liquidity. Their 2023 letter from the new CIO is worth the read.

Hence, think outside the box, don’t accept convention & maybe take some fringe risk with diversification as key to out-performance. See you in 12 months’ time for another review!

Next month onwards, back to the usual. Other than a catchy title to grab your attention. Data will be presented without any commentary. So that there won’t be biases in your interpretation & decision-making.