Class 10(b) Valuation: Growth & Terminal Value

To infinity & beyond in growth rate but please, come back to earth!

To recap, the sustainable growth formula only applies to mature stable companies. However, not many companies are in this stage, even for Coca-cola when we know the underlying consumer diet & habit is changing.

ROIC is not a steady state number, it changes

Let’s understand how growth reflects a changing growth via the following 5 companies:

All of the above companies have the same expected growth rate, but which has the least prospect? Firm 5 as it has only 1 year of growth, without any reinvestment further.

Which firm’s growth is scary? Firm 3 as it has 200% reinvestment rate that only generates 5% ROIC, which is also less than their cost of capital.

The best firm is Firm 1, with ROIC of 50% at only 20% reinvestment rate.

Hence, a growth rate alone is not enough without understanding the underlying cost of capital & reinvestment rate.

We need to break it down to the following:

Expected growth = Growth rate from new investment + Efficiency Growth

@ Reinvestment rate * ROC + ((New ROC / Old ROC) - 1)

If very few companies can have a sustainable growth rate, then we should have a growth rate that can be reliable. More so for companies that are in losses now but expect to have change in margins & profitability over time.

We can estimate growth via 3 inputs:

Revenue growth, margins & reinvestment rate

On revenue growth, we look at total market size & estimate the market share that we think the company will earn. Decrease the growth rate as it grows larger & keep track of the absolute revenue number to ensure it makes sense.

Next, we estimate the target margin once the growth rate stabilises, then we adjust the current margins towards that target margin.

We then use a sales to capital ratio to estimate the reinvestment needs each year.

Don’t we want the inputs above to be as high as possible?

Impossible as something needs to give. We look at the economics of each.

First is revenue growth & where is the constrain.

Market size becomes the 1st consideration. You want to be in a large (& growing) ocean instead of a small (& shrinking) pool. Next, is how will you rank against your competitors to earn more market share.

We’ll use AirBnb as an example. How big is their market?

Few years back, the answer is always there’s no market existed for such business. No one has done what AirBnb does. (This is also commonly used by investment bank to sell the client’s prospect, doesn’t matter what kind of business, they’ll always find a differentiation.)

Let’s break things down. Hotel is the closest comparable, let’s examine.

Prof. total up the hotel businesses globally & came up with $600b of revenue in 2018.

In 2013, Prof also use a similar approach for Uber where he estimated the car services / taxi business market size - about $100b in US.

1 of the early investor & director in Uber, Bill Gurley of Benchmark Capital emailed Prof & written a blog post with a pushback that this is underestimating the market size by 25x as Uber is changing the people’s behavior of using car service.

At the end of the post, Bill calculated that the real TAM is in the region of $0.45t to $1.3t. This is a good read on how to think bigger in market sizing if you are an aspiring VC.

Fun fact: Uber’s market cap is around ~$90b as of today Oct 2023 with ~$32b revenue. Using the mid-point of the TAM range at $0.9t, this put Uber’s (global) market share at only 4%. So, the next time when someone says if they can penetrate 10% of the market, let’s discount to only 4%, eh?

Hence, the principle of where you can change the market size, by shifting consumers’ behaviour. (Covid & work from home tools like Zoom is a recent example)

While is not wrong to use the current market as a starting point, the ending market size could well be larger than we thought if there’s a shift in consumers’ behavior to adopt the use case.

Overlaying on top of hospitality business is to look at OTAs like Expedia & Booking.com, an online platform that connects to hotel.

$200b was the bookings size of OTAs & the market is perhaps the commission charge for it, say 3% or $6b.

But nobody does this better than VCs themselves as excerpt from Airbnb’s prospectus below, i.e. from $1 trillion to $3 trillion combined with all the ‘experiences’ opportunities.

Another recent hype is a market size of Tesla that could worth $10 trillion if you include AI, Robotics, 24/7 Self-driving Autonomous Driving, Green Energy, etc.

All can be justified by Network Effect as illustrated by AirBnb below.

(A lot of sarcasm above to demonstrate there’s no ceiling in market size when times are good, please apply realistic market sizing on the companies you are evaluating. A trillion sounds like a sweet spot.)

Path in getting to a target margin

Key in setting a target margin is to know the constrain as well. A manufacturing company will never have the same high operating margin of a software company.

Hence, understanding business model, unit economics & market competitiveness is key.

A high margin niche business is possible, but the volume will be low. There’s always a trade-off.

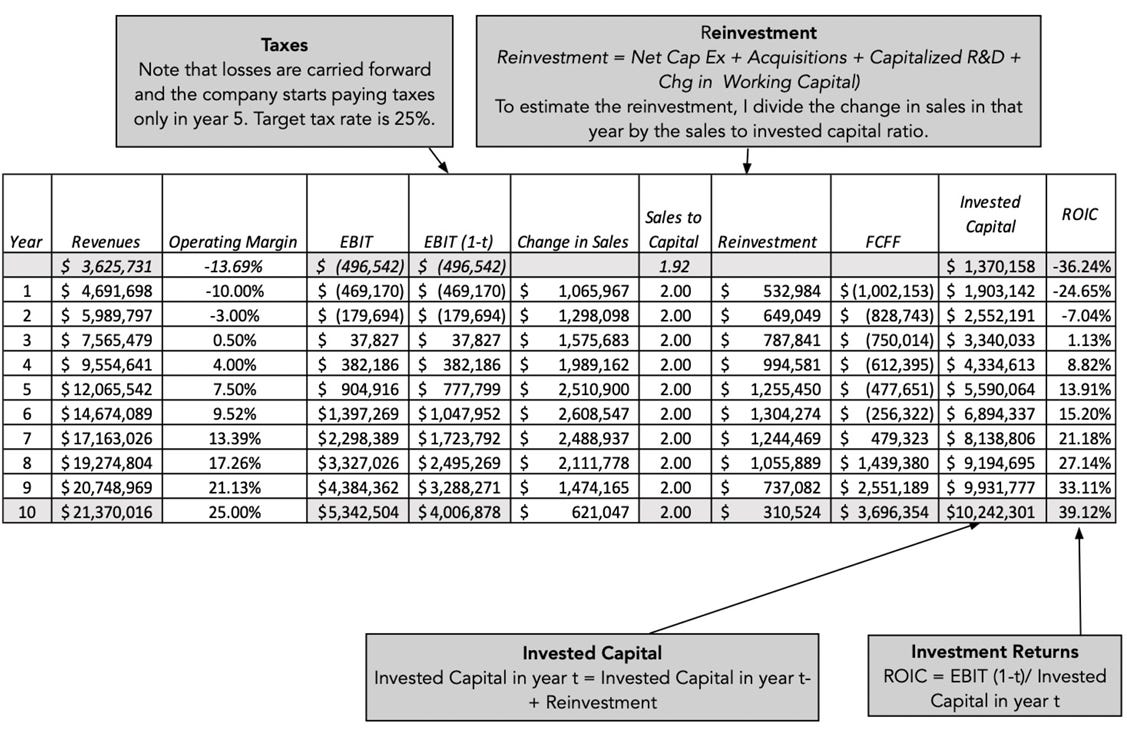

Below is an example of how Prof estimate growth & margins of AirBnb in November 2020. Notice the declining growth & expanding margins.

Expedia & Bookings.com are used as a benchmark to sense check. Even while 2 are comparable from the outset, they both took a different business model approach that causes Expedia to have thinner margins (purely as a platform) while Booking.com have higher margins (by acquiring hotel rooms).

Sales to Invested Capital - reinvestment rate

Another chance here for you to use a high number! However, it largely depends on the business model.

It’s not a constant number as well as this rate changes as the company matures. It may be higher in the first few years for a growth company but will become lower as companies become more efficient in deploying their capital.

Is also crucial to understand the current capacity of the company. A manufacturing plant may already have 50% capacity & don’t need to invest anything for next few years to achieve the same growth. This is an important note, assess the company’s capacity first before assigning growth to it.

Let’s relook back at Airbnb:

Note that the (Change in) Sales-Capital ratio is 2x to determine reinvestment amount for Airbnb as assumed by Prof throughout the projection period.

The Terminal Value

This is the biggest number in any DCF valuation hence the sensitivity of this component is big to overall valuation of the company.

There are 3 methods to estimating terminal value:

Liquidation value - this is the most accurate number. You’ll assume to sell the entire business by the end of the projection period. More projects related valuation uses this method as there’s always an end to a project. Other examples are valuing license or patent where there’s a finite life.

Perpetuity (Going concern or finite) - default assumption for most listed company. The longer the company survives up until now, 1 can assume the company will last into perpetuity. You can also assume a finite life of say 20 years.

Pricing via a multiple (P/E or EV/EBITDA) - most commonly used by investment bankers, they use EBITDA of the final projected year, & multiply that with a multiple of industry average or estimate. This is a sin for intrinsic valuation method because you are using pricing, inconsistency in method that is using discounted cash flow. Might as well just ignore DCF from the get-go & just apply a forward multiple.

The perpetuity method

As illustrated in the below formula:

Terminal Value = Cash Flow for next period / (Discount rate - perpetual growth rate)

Just based on math, to increase terminal value, 1 should have a denominator as low as possible. To do that effectively, just increase the perpetual growth rate!

This is the buzz lightyear growth rate!

1 pushback from Tesla fanatics earlier when prof valued Tesla was using a perpetual growth rate of 4%. Fans said Tesla is a special company & should use a higher growth rate.

To use such a high rate, the company will eventually become the economy!

Nothing about economics or finance theories. Is just the math that is working against even the most optimistic investment bankers out there.

Some rule:

the growth rate should be around the growth rate of the economy. In fact, it should be lower. Why? When an economy consists of stable & high growth firms. The aggregate result will also be biased to the high growth firms. Hence when you are valuing a stable firm, the growth rate should be less than the economy growth rate.

Stable growth rate can be negative! Fossil fuel companies that maintain to be a fossil fuel company (without changing business model) will be such example.

Again, consistency is key. If cashflow is nominal, growth rate should be in a nominal rate too, i.e. without effect on inflation, even when the inflation skyrockets.

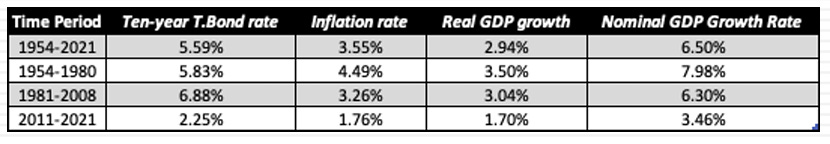

Some proxies & the final verdict:

Notice the GDP growth rate declines by the decade? Hang on to this.

First, let’s relook at Risk-free Rate, a refresher to previous class, or the 10-year T.Bond rate in the second column of the table above.

Class 4 Valuation: Risk & Risk-free rates

Class opening test: You have a choice of valuing a Brazilian company, either in US$ or in R$. Risk-free rate, Rfr for US is 2.5% & Brazil is 7.5%. Which currency will give you a higher valuation? a) US$, because of lower Rfr which will give a lower discount rate

The formula of Rfr is Expected Inflation + Expected Real Interest Rate

This looks similar to Nominal GDP Growth, where Expected Inflation + Expected Real Growth

Therefore, Risk-free Rate = Nominal GDP Growth

Imagine Rfr < Nominal GDP growth, economy will overheat & forms bubble.

If Rfr > Nominal GDP growth, economy will fall into recession.

Hence, for an economy to be stable, the growth has to be close to Rfr.

Prof. wager that by just looking at the 10-yr bond rate, he can predict where the economy will go. (For the US as of today, it is at 20 years high of 4.795%)

A common mistake for analysts earlier before the current rate hikes was to use then a low or close to zero Rfr against historical high growth rate & they wondered why they always overvalued a company.

Long term growth rate = Rfr is your best bet.

/ / end of Class 10(b) Valuation