Class 1: Introduction to Corporate Finance & Valuation

What is Valuation & Corporate Finance, Who is Aswath Damodaran?

The Spring 2023 Class of Valuation & Corporate Finance commenced on January 30th, 2023. It runs for 26 classes and ends on May 8th, 2023. Valuation & Corporate Finance are 2 separate subjects taught in Damodaran’s MBA programme. Valuation is taught at undergraduate level as well but not Corporate Finance.

If you haven’t heard of Aswath Damodaran, he is a legend in the finance community. Apart from teaching in NYU since 1986, he has written numerous books on valuation and corporate finance. Almost every finance professional that does valuation or security analysis would have his Valuation bible. Learning from him first-hand is as good as a CFA certification!

Thanks to technology, we can now learn first-hand from him virtually via recorded class videos. That is the purpose of this blog, it is to be my notes accompanied by the videos. Thus, maximising my learning abilities of lecture recordings, slides, own notes and as well as personal experiences.

I have been in the finance industry for 15 years now, have done investment banking, deals advisory, private equity and multi-asset portfolios. I have also run and exited my own ventures. At the same time also consulted and advised clients of my own. You can read more about my journey in my intro post below:

Structuring and corporate finance is not much of an issue. Valuation has always been a contentious point in my career, is 1 thing to convince your opponent (regardless of if you are on the sell side or buy side) but is a frustration when you need to convince your own boss or peers on why valuation is done in the way it is.

A 30-year concession should not have a terminal value and yet bosses somehow wanted to just use an EBITDA multiple to justify valuation. Or even if a multiple is used, to add back cash & PPE into it to inflate the numbers but ignored the debt.

This is on the sell side; and on the buy side how do you answer to old-fashioned Mr.Scrooge that sarcastically open the table by saying your company has no value? Worst, negative value?

While this class is more like a refresher, an update on the latest thoughts and events (for e.g. why Meta, Tesla and Adani are undervalued after their recent crash), it is for me to document down these notes and learnings into something tangible publicly so that when unreasonable ask and response is given, I will point them to this blog.

Experiences that I have gained would hopefully give me better contexts in my notetaking.

“Corporate Finance (“CF”) is the only finance class that matters in business school, everything else is a spin off."

This is Prof. Damodaran's 39th year teaching CF. CF is more of a practice & learning from experience hence strong fundamental background on business understanding is needed. Valuation is part of CF, so by learning CF, you’ll learn (some) valuation.

With Valuation as a class itself, it is where we go deep into the intricacies & nuances, but it can be also easy & fun like story telling. As Prof said, everyone can value Coca-Cola, even a kid!

NB: I’ll combine 2 of the intro classes into this post but next posts onwards will be distinctly either CF or Valuation as we go deep.

While notes are mine, all credits go to Aswath Damodaran.

Basic Fundamentals

To understand CF/Valuation, 3 discipline must first be obtained, at least on a basic level.

They are Accounting, Statistics & Finance.

Accounting - the raw material on understanding a company's financials.

Damodaran's accounting by non-accountant video series

Statistics - to make sense on data that is large and contradictory, particularly useful in Valuation.

Damodaran's statistics 101

Finance

Damodaran's finance foundation

What is Corporate Finance?

Many CF classes (and practitioner) spent a lot of time on the Financing part of CF, i.e. how to raise money, what is the right mix. If you work in an Investment Bank (in CF division), is all Financing, i.e. bonds, rights, convertibles, etc.

This class won’t help you in getting an IB job, in fact it will make you do worse as your new CF knowledge makes you question everything you will be asked to do which won't make sense (violating first principles, see below)!

This is not a class that prepares you for consulting either however, this is a class about the financial principles on how to run a business.

“CF covers any decision that involves the use of money. Money is always being spent (salaries, marketing, HR, strat). Hopefully, you do something to bring some money in. Every class in the MBA programme is in service of this class.”

The Book Value

First, we visualise the balance sheet from an accountant point of view. A book of what you own, and what you owe; and what’s wrong with them!

Long Lived Real Assets - An equipment is what you paid but accountant says this needs to be depreciated, so what you bought 50 years ago, should worth zero now even it can still be use for many years.

Short Lived Assets - is close to what you paid on things like inventories. (If there's a difference, big problem.)

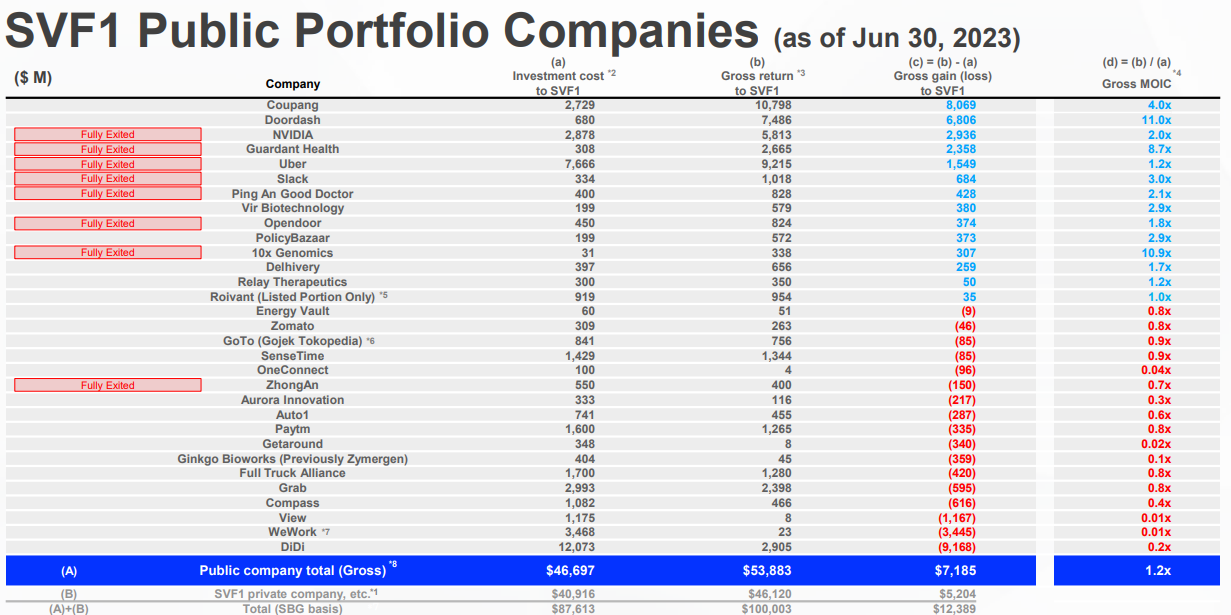

Financial Investments - if you are holding these for trade, you have to mark-to-market. When Softbank invests in WeWork & thought it was worth $48b but 6 months down the road it realise Adam Neumann was a fraud and it has to write it down to $3b.

But if you buy a business for strategic reason (dangerous business term), you don’t need to mark-to-market? See below on danger of Goodwill too.

In 2014, Prof valued Yahoo at $4b based on earnings & cashflow, a search engine that nobody searches & an email that only old people uses. (Verizon bought Yahoo for $4.5b in 2017 which was eventually sold to Apollo for $5b in 2021.)

However, Yahoo was priced at $40b back then because of its 21% stake in Alibaba that is deemed to IPO soon. The $40b value was basically Yahoo’s stake in Alibaba's IPO value. On the balance sheet of Yahoo, Alibaba was only worth $0.5b, what Yahoo paid initially.

Intangible Assets - can value of a company come from something they can’t see? The most valuable companies today don’t derive their value from tangible assets anymore. A big rise of Intangible in recent years is due to Goodwill from business acquisitions.

“Goodwill is the most dangerous item ever created. The minute you acquire a company, goodwill pops up. This number is the difference between the purchase price & book value. Without goodwill, balance sheet doesn’t balance. Goodwill is just a plug variable, extremely dangerous.”

When you look at balance sheet, you are going to see a collection of different set of rules which are internally inconsistent, and they won’t change due to legacy problems.

On Shareholders’ Equity - only reflects the history about the company’s equity, nothing about the value of shareholders’.

Over the next few classes, we need to learn on how to develop a Financial Balance Sheet. For e.g. to understand Growth Assets.

When you look at Tesla & Palantir, you don’t look at what they have done, you look at what they will do in the future.

We’ll also be learning about company lifecycle, to understand at what stage a company is in and what financing to use.

A company like OpenAI will have very little information from balance sheet, doing ratio on that is a waste of time.

Black Magic of Valuation

First, which of the following company type is where valuation is useful?

Matured company in a stable economy.

Matured company in an unstable economy.

Young company in a stable economy.

Young company in an unstable economy

Company Type 1 is like Coca-Cola, matured company in a stable economy. Valuation on these types of companies is easiest & can even be automated.

At another extreme of Company Type 4, there’s just too much uncertainty on young company in unstable economy. This is where Valuation is fun & useful.

On a side note, VC don't value companies, they price companies; there's a difference between value & price.

Second, are you comfortable telling stories or counting numbers? You know a long time of what you are, left brain or right brain. However, you need both side of your brain, story and numbers to do valuation.

By end of the class, if you are left brain person, hopefully you will gain some imagination & story telling capability and if you are right brain, to have the discipline of data & numbers to complement your story.

Third, is Valuation - Science, Art or Something else like Black Magic?

We first digress to learn more about the Master.

About Aswath Damodaran

The fact that he has been teaching in NYU Stern for close to 4 decades, he has witnessed the market crash of 1987 (Wall Street is 10 mins away from NYU Stern), valued Amazon in 1997 as just an online bookstore, valued Boeing in March 2020 (Viral Market Meltdown series) just when Covid happened.

Everything he knows about Valuation is based on current events and documented in his blog. The powerful knowledge of valuation allows you to value something & find opportunities during a crisis, and not only until crisis is over that you start to value.

“You invest in the market you are in, not the market you want to be in.”

The past decade has witnessed a lot of “big numbers” companies or companies with big market potential like Facebook & Netflix. For e.g. Facebook has a user base of 3 billion in its ecosystem and Netflix’ massive subscribers retention rate economics. Valuation also helps you understand business models.

In 2020, inflation was a forgotten middle child & last year (2022), inflation comes back like a problem child. As we know, inflation impacts valuation and somehow people forgotten about that.

In summary, this is a summation of Prof.’s experiences structured in a class.

Welcome to the journey because this process doesn’t end.

I - Valuation is not Science or Art but a Craft

Not Science - you are either right or wrong in Science, but Valuation has many variations. You can give the perfect inputs (valuing Mariott in June 2019), but the output can be wrong (1 year later at peak of pandemic).

Not Art - great artist have some element of genius (born & not bred).

It’s Craft - you learn Valuation by doing, the better you are the more you do it. Just like you learn cooking by cooking. You also never master a craft; it is a continuing process.

Hence, every week, there will be a valuation exercise. This week is Tesla. As you progress, you will form you own value & disagree with Aswath’s valuation.

II - Price ≠ Value

Value is always a function of cashflow, growth & risk.

Price is a function of demand & supply, i.e. mood, momentum & revenge (Gamestop - Buying frenzy from r/Wallstreetbets & short squeeze from hedge funds, the bad guys).

You learn about emotions in behavioral finance, revenge is the strongest emotion and hence wild price volatility.

Equity analysts doing PE ratio benchmark is pricing, not valuation. Pricing is also a skill which will be taught in this class.

III - Valuation is Universal & Simple

Everything can be valued, not just listed companies but also private entity and assets, as long as there is cash flow.

Everything else is pricing - crypto, currency, real estate, Picasso & commodities.

Even Options can be valued, i.e. natural resources, patents, users, tech platforms & distressed assets.

IV - Good Valuation = Numbers + Stories

When Prof valued Tesla at $400b, he is telling the story of not just EV cars adoption, but software & AI. Good valuation is a bridge between numbers & stories.

For the number crunchers, without stories, numbers can be manipulated, hide bias or to intimidate the unfamiliar.

For the story tellers, without anchoring to numbers, can be fairy tales, leading to unreal valuations. Story of a good management, good founder or good future needs to be shown in numbers.

Students (who are mostly numbers crunchers) need to get comfortable to imagining.

(In early years, storytelling is not being advocated (or discovered) in prof’s class. It was all about equations & numbers. Only in recent years that he added this advocacy which is tied to the next principle of Having Faith.)

V - Have Faith

Prof. don’t do paid valuation consultation or expert witness but merely to do it for himself & act on it., i.e. to buy a stock that he values (if is undervalued). This is a big ask because it involves a lot of faith as the underlying has a lot of assumptions. You can’t prove that your value is right until it is manifested.

Is easy to value but difficult to have faith. Faith can be tested many times. Market will always ask you “Do you still have faith?”. There’s no absolute answer & is a healthy reaction.

First Principle & The Big Picture of Corporate Finance

CF is to maximise the value of a firm (First Principle) & every business only make 3 major decisions to maximise that value.

Investment Decision - what to buy, which project to take. Make sure the returns must be above the minimum acceptable hurdle rate. Hurdle rate should reflect the risk of the investment & the mix of debt/equity. Return must be based on cash flow (in & out) over the life of the project, as opposed to earnings (accounting). The shorter the life, the better due to time value of money.

Strategic decision or “synergy” is the cheat code when numbers don't jive. Our job is sometimes to turn these cheat codes into numbers. i.e. New products, new channels, etc.

Financing Decision - mix of equity & debt to fund the business/project. Matching debts to assets is important. i.e. a German infra project (that is long term) should be financed mostly in long term debt and in Euros (not USD).

Dividend Decision - how much cash to extract/retain. A successful business will eventually need to return cash to the owners. For a listed company, not just dividends but also share buybacks.

Each lifecycle of a business has different weight of the 3 decisions to make.

2/3 of companies die at toddlerhood (startups). Tesla is a corporate teenager (focus entirely on investing), Coca-cola is old (objective is to lower hurdle rate), GE is beyond dementia, walking dead (objective is to extract cash & become smaller).

Biggest value destruction is when company don’t act their age. Old companies acting young. There’s an ecosystem where they convince old company they can be young again. This is the management consulting ecosystem.

CF is about running business, not just for “corporate” but for any business. A Hot Dog stand introducing new hot dog flavour is a big investment decision!

Companies that (always) violate first principle will pay the price.

For e.g., in the 90s, Steady Safe is a growing taxi company in Indonesia, a fast-growing country at that time. They went to an Investment Bank called Peregrine to get more loans to buy more taxis. Instead of getting a 10-yr loan (lifespan of a car) in Indonesia Rupiah, they were given in USD because it is “cheaper”. The banker also convinces that nothing bad will happen since USDIDR were pegged at that time.

It worked out first in early years of the loan, until in 1996 when the Indonesian government decided to devalue their Rupiah by 60%. Steady Safe went bankrupt due to this and took down Peregrine too (Half of Peregrine loan book was in Steady Safe)

There’s an entire industry called “Carry Trade” which will blow up eventually though you are being rewarded temporarily. 2022 is a good example where everyone pays the price of violating the first principle.

CF is applied finance, which will be demonstrated on 6 companies (via group assignments) - Vale, Disney, Bookscape, Deutsche Bank, Baidu & Tata Motors.

There’s also a group assignment to apply the concepts learned on a chosen company of your own. // Class 1 of CF & Valuation ends